Free Access | 2024-04-12

Why is Coffee from Kenya and Rwanda Priced Higher Globally than Coffee from Uganda?

Authors/Editors: Swaibu Mbowa (PhD) , Florence Nakazi , Ezra F. Munyambonera

Abstract:

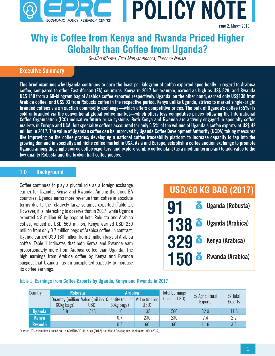

This brief examines why Uganda continues to earn the least per kilogram of coffee exported specifically in regard to Arabica coffee, compared to other East African (EA) countries. Kenya in 2017 for example, earned as high as US$ 329, and Rwanda US$ 150 from a 60-kilogram bag of Arabica coffee exported respectively. Uganda, on the other hand, earned only US$138 from Arabica coffee, and US$ 93 from Robusta coffee in the respective period. Kenya unlike Uganda, strives to market single-origin branded coffees via an auction commodity exchange—which offers competitive prices. The bulk of Uganda’s coffee (85%) is sold unbranded via the conventional global coffee market—which offers less competitive prices following the International Coffee Organisation (ICO) indicative future price systems. Both Kenya and Rwanda are actively engaged in specialty coffee markets in Europe and USA, but speciality coffees accounted for only 5.5% of the volume of Uganda’s coffee exports-at US$ 42 million in 2017. The value of Ugandan coffee can be improved by Uganda Coffee Development Authority (UCDA) taking measures like improving on the coffee grades; developing a national coffee traceability platform to increase capacity to tap into the growing demand in specialty and niche coffee market in USA, Asia and Europe; establish a coffee auction exchange to promote Uganda among the single source coffee exporters, and explore soluble coffee plant (as a medium term plan) to add value to the low quality Robusta and the broken half coffee pieces.

DETAILS

Pub Date: March 2019

Document N0.: 1

Volume: 2

Published By: Economic Policy Research Centre